Chapter 4: Optimal Stopping#

firm_exit.jl#

"""

Firm valuation with exit option.

"""

using QuantEcon, LinearAlgebra

include("s_approx.jl")

"Creates an instance of the firm exit model."

function create_exit_model(;

n=200, # productivity grid size

ρ=0.95, μ=0.1, ν=0.1, # persistence, mean and volatility

β=0.98, s=100.0 # discount factor and scrap value

)

mc = tauchen(n, ρ, ν, μ)

z_vals, Q = mc.state_values, mc.p

return (; n, z_vals, Q, β, s)

end

"Compute value of firm without exit option."

function no_exit_value(model)

(; n, z_vals, Q, β, s) = model

return (I - β * Q) \ z_vals

end

" The Bellman operator Tv = max{s, π + β Q v}."

function T(v, model)

(; n, z_vals, Q, β, s) = model

h = z_vals .+ β * Q * v

return max.(s, h)

end

" Get a v-greedy policy."

function get_greedy(v, model)

(; n, z_vals, Q, β, s) = model

σ = s .>= z_vals .+ β * Q * v

return σ

end

"Solve by VFI."

function vfi(model)

v_init = no_exit_value(model)

v_star = successive_approx(v -> T(v, model), v_init)

σ_star = get_greedy(v_star, model)

return v_star, σ_star

end

# Plots

using PyPlot

using LaTeXStrings

PyPlot.matplotlib[:rc]("text", usetex=true) # allow tex rendering

fontsize=16

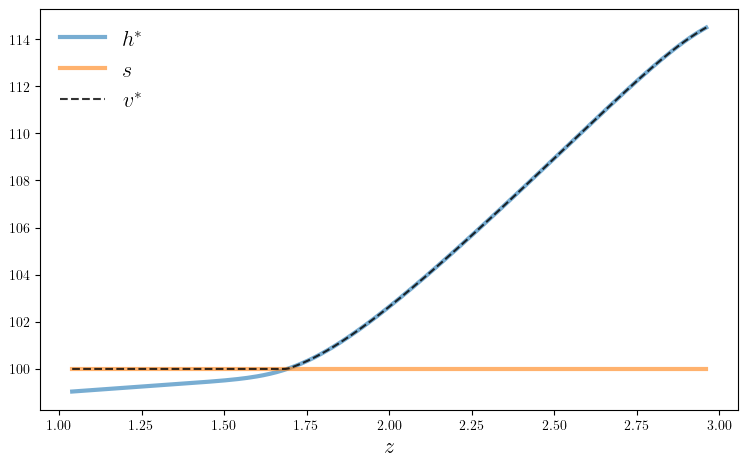

function plot_val(; savefig=false,

figname="./figures/firm_exit_1.pdf")

fig, ax = plt.subplots(figsize=(9, 5.2))

model = create_exit_model()

(; n, z_vals, Q, β, s) = model

v_star, σ_star = vfi(model)

h = z_vals + β * Q * v_star

ax.plot(z_vals, h, "-", lw=3, alpha=0.6, label=L"h^*")

ax.plot(z_vals, s * ones(n), "-", lw=3, alpha=0.6, label=L"s")

ax.plot(z_vals, v_star, "k--", lw=1.5, alpha=0.8, label=L"v^*")

ax.legend(frameon=false, fontsize=fontsize)

ax.set_xlabel(L"z", fontsize=fontsize)

if savefig

fig.savefig(figname)

end

end

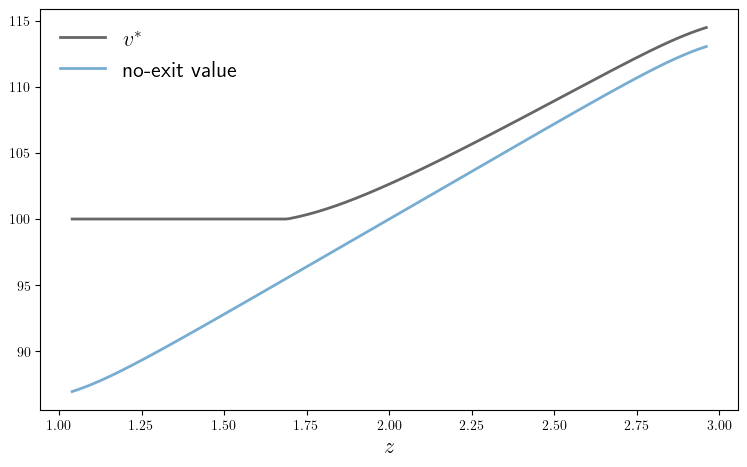

function plot_comparison(; savefig=false,

figname="./figures/firm_exit_2.pdf")

fig, ax = plt.subplots(figsize=(9, 5.2))

model = create_exit_model()

(; n, z_vals, Q, β, s) = model

v_star, σ_star = vfi(model)

w = no_exit_value(model)

ax.plot(z_vals, v_star, "k-", lw=2, alpha=0.6, label=L"v^*")

ax.plot(z_vals, w, lw=2, alpha=0.6, label="no-exit value")

ax.legend(frameon=false, fontsize=fontsize)

ax.set_xlabel(L"z", fontsize=fontsize)

if savefig

fig.savefig(figname)

end

end

plot_comparison (generic function with 1 method)

plot_val(savefig=true)

Completed iteration 25 with error 0.03580715900042719.

Completed iteration 50 with error 0.017225068626785855.

Completed iteration 75 with error 0.0067683556226683095.

Completed iteration 100 with error 0.002642877005854416.

Completed iteration 125 with error 0.001043441654857702.

Completed iteration 150 with error 0.0004139022964579908.

Completed iteration 175 with error 0.00016428959624192885.

Completed iteration 200 with error 6.52164784469278e-5.

Completed iteration 225 with error 2.5888622730008137e-5.

Completed iteration 250 with error 1.027687515886555e-5.

Completed iteration 275 with error 4.079559602132576e-6.

Completed iteration 300 with error 1.6194423437809746e-6.

Terminated successfully in 315 iterations.

plot_comparison(savefig=true)

Completed iteration 25 with error 0.03580715900042719.

Completed iteration 50 with error 0.017225068626785855.

Completed iteration 75 with error 0.0067683556226683095.

Completed iteration 100 with error 0.002642877005854416.

Completed iteration 125 with error 0.001043441654857702.

Completed iteration 150 with error 0.0004139022964579908.

Completed iteration 175 with error 0.00016428959624192885.

Completed iteration 200 with error 6.52164784469278e-5.

Completed iteration 225 with error 2.5888622730008137e-5.

Completed iteration 250 with error 1.027687515886555e-5.

Completed iteration 275 with error 4.079559602132576e-6.

Completed iteration 300 with error 1.6194423437809746e-6.

Terminated successfully in 315 iterations.

american_option.jl#

"""

Valuation for finite-horizon American call options in discrete time.

"""

include("s_approx.jl")

using QuantEcon, LinearAlgebra, IterTools

"Creates an instance of the option model with log S_t = Z_t + W_t."

function create_american_option_model(;

n=100, μ=10.0, # Markov state grid size and mean value

ρ=0.98, ν=0.2, # persistence and volatility for Markov state

s=0.3, # volatility parameter for W_t

r=0.01, # interest rate

K=10.0, T=200) # strike price and expiration date

t_vals = collect(1:T+1)

mc = tauchen(n, ρ, ν)

z_vals, Q = mc.state_values .+ μ, mc.p

w_vals, φ, β = [-s, s], [0.5, 0.5], 1 / (1 + r)

e(t, i_w, i_z) = (t ≤ T) * (z_vals[i_z] + w_vals[i_w] - K)

return (; t_vals, z_vals, w_vals, Q, φ, T, β, K, e)

end

"The continuation value operator."

function C(h, model)

(; t_vals, z_vals, w_vals, Q, φ, T, β, K, e) = model

Ch = similar(h)

z_idx, w_idx = eachindex(z_vals), eachindex(w_vals)

for (t, i_z) in product(t_vals, z_idx)

out = 0.0

for (i_w′, i_z′) in product(w_idx, z_idx)

t′ = min(t + 1, T + 1)

out += max(e(t′, i_w′, i_z′), h[t′, i_z′]) *

Q[i_z, i_z′] * φ[i_w′]

end

Ch[t, i_z] = β * out

end

return Ch

end

"Compute the continuation value function by successive approx."

function compute_cvf(model)

h_init = zeros(length(model.t_vals), length(model.z_vals))

h_star = successive_approx(h -> C(h, model), h_init)

return h_star

end

# Plots

using PyPlot

using LaTeXStrings

PyPlot.matplotlib[:rc]("text", usetex=true) # allow tex rendering

fontsize=16

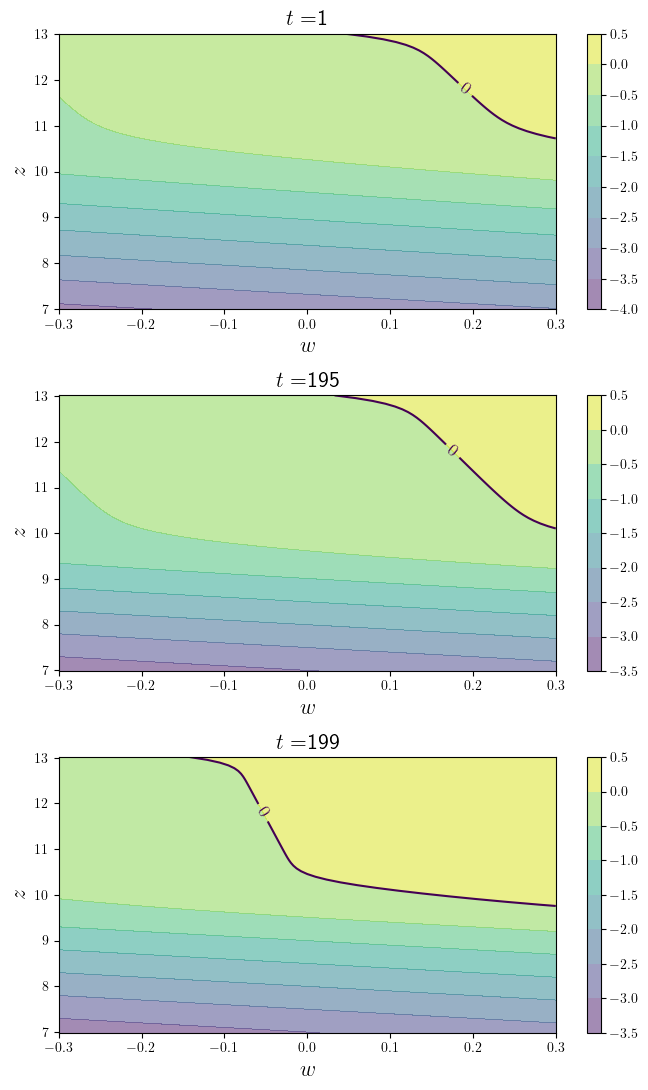

function plot_contours(; savefig=false,

figname="./figures/american_option_1.pdf")

model = create_american_option_model()

(; t_vals, z_vals, w_vals, Q, φ, T, β, K, e) = model

h_star = compute_cvf(model)

fig, axes = plt.subplots(3, 1, figsize=(7, 11))

z_idx, w_idx = eachindex(z_vals), eachindex(w_vals)

H = zeros(length(w_vals), length(z_vals))

for (ax_index, t) in zip(1:3, (1, 195, 199))

ax = axes[ax_index, 1]

for (i_w, i_z) in product(w_idx, z_idx)

H[i_w, i_z] = e(t, i_w, i_z) - h_star[t, i_z]

end

cs1 = ax.contourf(w_vals, z_vals, transpose(H), alpha=0.5)

ctr1 = ax.contour(w_vals, z_vals, transpose(H), levels=[0.0])

plt.clabel(ctr1, inline=1, fontsize=13)

plt.colorbar(cs1, ax=ax) #, format="%.6f")

ax.set_title(L"t=" * "$t", fontsize=fontsize)

ax.set_xlabel(L"w", fontsize=fontsize)

ax.set_ylabel(L"z", fontsize=fontsize)

end

fig.tight_layout()

if savefig

fig.savefig(figname)

end

end

function plot_strike(; savefig=false,

fontsize=12,

figname="./figures/american_option_2.pdf")

model = create_american_option_model()

(; t_vals, z_vals, w_vals, Q, φ, T, β, K, e) = model

h_star = compute_cvf(model)

# Built Markov chains for simulation

z_mc = MarkovChain(Q, z_vals)

P_φ = zeros(length(w_vals), length(w_vals))

for i in eachindex(w_vals) # Build IID chain

P_φ[i, :] = φ

end

w_mc = MarkovChain(P_φ, w_vals)

y_min = minimum(z_vals) + minimum(w_vals)

y_max = maximum(z_vals) + maximum(w_vals)

fig, axes = plt.subplots(3, 1, figsize=(7, 12))

for ax in axes

# Generate price series

z_draws = simulate_indices(z_mc, T, init=Int(length(z_vals) / 2 - 10))

w_draws = simulate_indices(w_mc, T)

s_vals = z_vals[z_draws] + w_vals[w_draws]

# Find the exercise date, if any.

exercise_date = T + 1

for t in 1:T

if e(t, w_draws[t], z_draws[t]) ≥ h_star[w_draws[t], z_draws[t]]

exercise_date = t

end

end

@assert exercise_date ≤ T "Option not exercised."

# Plot

ax.set_ylim(y_min, y_max)

ax.set_xlim(1, T)

ax.fill_between(1:T, ones(T) * K, ones(T) * y_max, alpha=0.2)

ax.plot(1:T, s_vals, label=L"S_t")

ax.plot((exercise_date,), (s_vals[exercise_date]), "ko")

ax.vlines((exercise_date,), 0, (s_vals[exercise_date]), ls="--", colors="black")

ax.legend(loc="upper left", fontsize=fontsize)

ax.text(-10, 11, "in the money", fontsize=fontsize, rotation=90)

ax.text(-10, 7.2, "out of the money", fontsize=fontsize, rotation=90)

ax.text(exercise_date-20, 6, #s_vals[exercise_date]+0.8,

"exercise date", fontsize=fontsize)

ax.set_xticks((1, T))

ax.set_yticks((y_min, y_max))

end

if savefig

fig.savefig(figname)

end

end

plot_strike (generic function with 1 method)

plot_contours(savefig=true)

Completed iteration 25 with error 0.006681671219211427.

Completed iteration 50 with error 0.0039970038843408495.

Completed iteration 75 with error 0.002922808660469428.

Completed iteration 100 with error 0.0019603799011774503.

Completed iteration 125 with error 0.0012415595933039647.

Completed iteration 150 with error 0.00077388789719951.

Completed iteration 175 with error 0.000481112768765779.

Completed iteration 200 with error 0.0.

Terminated successfully in 201 iterations.

plot_strike(savefig=true)

Completed iteration 25 with error 0.006681671219211427.

Completed iteration 50 with error 0.0039970038843408495.

Completed iteration 75 with error 0.002922808660469428.

Completed iteration 100 with error 0.0019603799011774503.

Completed iteration 125 with error 0.0012415595933039647.

Completed iteration 150 with error 0.00077388789719951.

Completed iteration 175 with error 0.000481112768765779.

Completed iteration 200 with error 0.0.

Terminated successfully in 201 iterations.

AssertionError: Option not exercised.

Stacktrace:

[1] plot_strike(; savefig::Bool, fontsize::Int64, figname::String)

@ Main ./In[5]:130

[2] top-level scope

@ In[7]:1