Chapter 4: Optimal Stopping#

firm_exit.py#

"""

Firm valuation with exit option.

"""

from quantecon.markov import tauchen

from quantecon import compute_fixed_point

import numpy as np

from collections import namedtuple

from numba import njit

# NamedTuple Model

Model = namedtuple("Model", ("n", "z_vals", "Q", "β", "s"))

def create_exit_model(

n=200, # productivity grid size

ρ=0.95, μ=0.1, ν=0.1, # persistence, mean and volatility

β=0.98, s=100.0 # discount factor and scrap value

):

"""

Creates an instance of the firm exit model.

"""

mc = tauchen(n, ρ, ν, mu=μ)

z_vals, Q = mc.state_values, mc.P

return Model(n=n, z_vals=z_vals, Q=Q, β=β, s=s)

@njit

def no_exit_value(model):

"""Compute value of firm without exit option."""

n, z_vals, Q, β, s = model

I = np.identity(n)

return np.linalg.solve((I - β * Q), z_vals)

@njit

def T(v, model):

"""The Bellman operator Tv = max{s, π + β Q v}."""

n, z_vals, Q, β, s = model

h = z_vals + β * np.dot(Q, v)

return np.maximum(s, h)

@njit

def get_greedy(v, model):

"""Get a v-greedy policy."""

n, z_vals, Q, β, s = model

σ = s >= z_vals + β * np.dot(Q, v)

return σ

def vfi(model):

"""Solve by VFI."""

v_init = no_exit_value(model)

v_star = compute_fixed_point(lambda v: T(v, model), v_init, error_tol=1e-6,

max_iter=1000, print_skip=25)

σ_star = get_greedy(v_star, model)

return v_star, σ_star

# Plots

import matplotlib.pyplot as plt

import matplotlib.pyplot as plt

plt.rcParams.update({"text.usetex": True, "font.size": 14})

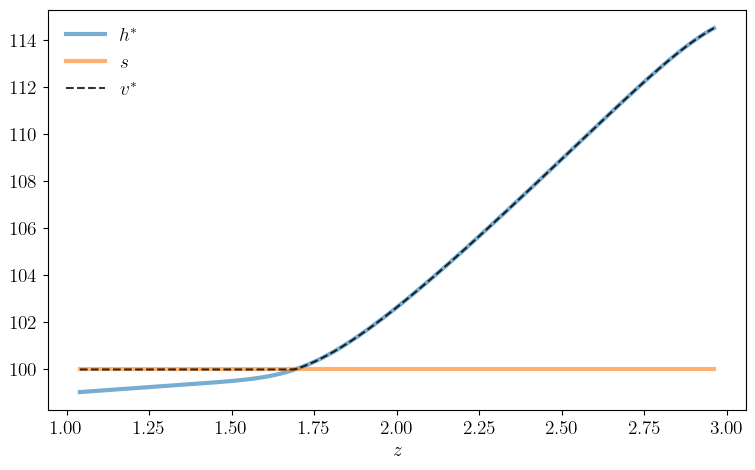

def plot_val(savefig=False,

figname="./figures/firm_exit_1.pdf"):

fig, ax = plt.subplots(figsize=(9, 5.2))

model = create_exit_model()

n, z_vals, Q, β, s = model

v_star, σ_star = vfi(model)

h = z_vals + β * np.dot(Q, v_star)

ax.plot(z_vals, h, "-", linewidth=3, alpha=0.6, label=r"$h^*$")

ax.plot(z_vals, s * np.ones(n), "-", linewidth=3, alpha=0.6, label=r"$s$")

ax.plot(z_vals, v_star, "k--", linewidth=1.5, alpha=0.8, label=r"$v^*$")

ax.legend(frameon=False)

ax.set_xlabel(r"$z$")

if savefig:

fig.savefig(figname)

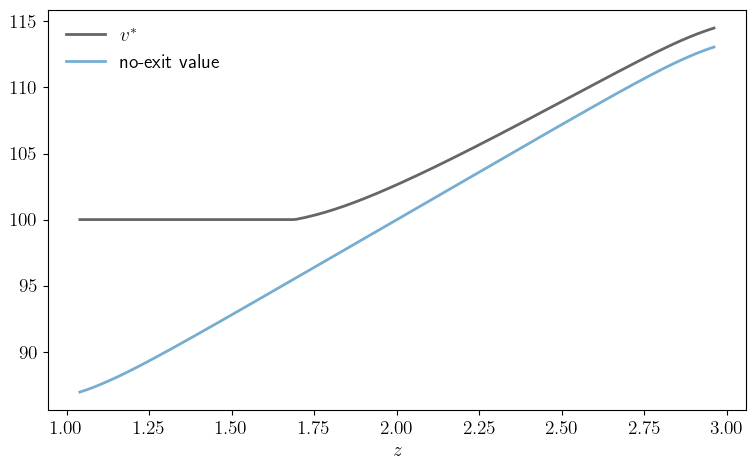

def plot_comparison(savefig=False,

figname="./figures/firm_exit_2.pdf"):

fig, ax = plt.subplots(figsize=(9, 5.2))

model = create_exit_model()

n, z_vals, Q, β, s = model

v_star, σ_star = vfi(model)

w = no_exit_value(model)

ax.plot(z_vals, v_star, "k-", linewidth=2, alpha=0.6, label="$v^*$")

ax.plot(z_vals, w, linewidth=2, alpha=0.6, label="no-exit value")

ax.legend(frameon=False)

ax.set_xlabel(r"$z$")

if savefig:

fig.savefig(figname)

plot_val()

Iteration Distance Elapsed (seconds)

---------------------------------------------

25 3.581e-02 8.320e-01

50 1.723e-02 8.329e-01

75 6.768e-03 8.335e-01

100 2.643e-03 8.341e-01

125 1.043e-03 8.347e-01

150 4.139e-04 8.353e-01

175 1.643e-04 8.359e-01

200 6.522e-05 8.366e-01

225 2.589e-05 8.372e-01

250 1.028e-05 8.379e-01

275 4.080e-06 8.385e-01

300 1.619e-06 8.391e-01

314 9.653e-07 8.395e-01

Converged in 314 steps

plot_comparison()

Iteration Distance Elapsed (seconds)

---------------------------------------------

25 3.581e-02 7.725e-04

50 1.723e-02 1.290e-03

75 6.768e-03 1.779e-03

100 2.643e-03 2.271e-03

125 1.043e-03 2.758e-03

150 4.139e-04 3.296e-03

175 1.643e-04 3.823e-03

200 6.522e-05 4.346e-03

225 2.589e-05 4.831e-03

250 1.028e-05 5.316e-03

275 4.080e-06 5.803e-03

300 1.619e-06 6.342e-03

314 9.653e-07 6.663e-03

Converged in 314 steps

american_option.py#

"""

Valuation for finite-horizon American call options in discrete time.

"""

from quantecon.markov import tauchen, MarkovChain

from quantecon import compute_fixed_point

import numpy as np

from collections import namedtuple

from numba import njit, prange

# NamedTuple Model

Model = namedtuple("Model", ("t_vals", "z_vals","w_vals", "Q",

"φ", "T", "β", "K"))

@njit

def exit_reward(t, i_w, i_z, T, K):

"""Payoff to exercising the option at time t."""

return (t < T) * (i_z + i_w - K)

def create_american_option_model(

n=100, μ=10.0, # Markov state grid size and mean value

ρ=0.98, ν=0.2, # persistence and volatility for Markov state

s=0.3, # volatility parameter for W_t

r=0.01, # interest rate

K=10.0, T=200): # strike price and expiration date

"""

Creates an instance of the option model with log S_t = Z_t + W_t.

"""

t_vals = np.arange(T+1)

mc = tauchen(n, ρ, ν)

z_vals, Q = mc.state_values + μ, mc.P

w_vals, φ, β = np.array([-s, s]), np.array([0.5, 0.5]), 1 / (1 + r)

return Model(t_vals=t_vals, z_vals=z_vals, w_vals=w_vals, Q=Q,

φ=φ, T=T, β=β, K=K)

@njit(parallel=True)

def C(h, model):

"""The continuation value operator."""

t_vals, z_vals, w_vals, Q, φ, T, β, K = model

Ch = np.empty_like(h)

z_idx, w_idx = np.arange(len(z_vals)), np.arange(len(w_vals))

for i in prange(len(t_vals)):

t = t_vals[i]

for i_z in prange(len(z_vals)):

out = 0.0

for i_w_1 in prange(len(w_vals)):

for i_z_1 in prange(len(z_vals)):

t_1 = min(t + 1, T)

out += max(exit_reward(t_1, w_vals[i_w_1], z_vals[i_z_1], T, K),

h[t_1, i_z_1]) * Q[i_z, i_z_1] * φ[i_w_1]

Ch[t, i_z] = β * out

return Ch

def compute_cvf(model):

"""

Compute the continuation value function by successive approx.

"""

h_init = np.zeros((len(model.t_vals), len(model.z_vals)))

h_star = compute_fixed_point(lambda h: C(h, model), h_init,

error_tol=1e-6, max_iter=1000,

print_skip=25)

return h_star

# Plots

import matplotlib.pyplot as plt

import matplotlib.pyplot as plt

plt.rcParams.update({"text.usetex": True, "font.size": 14})

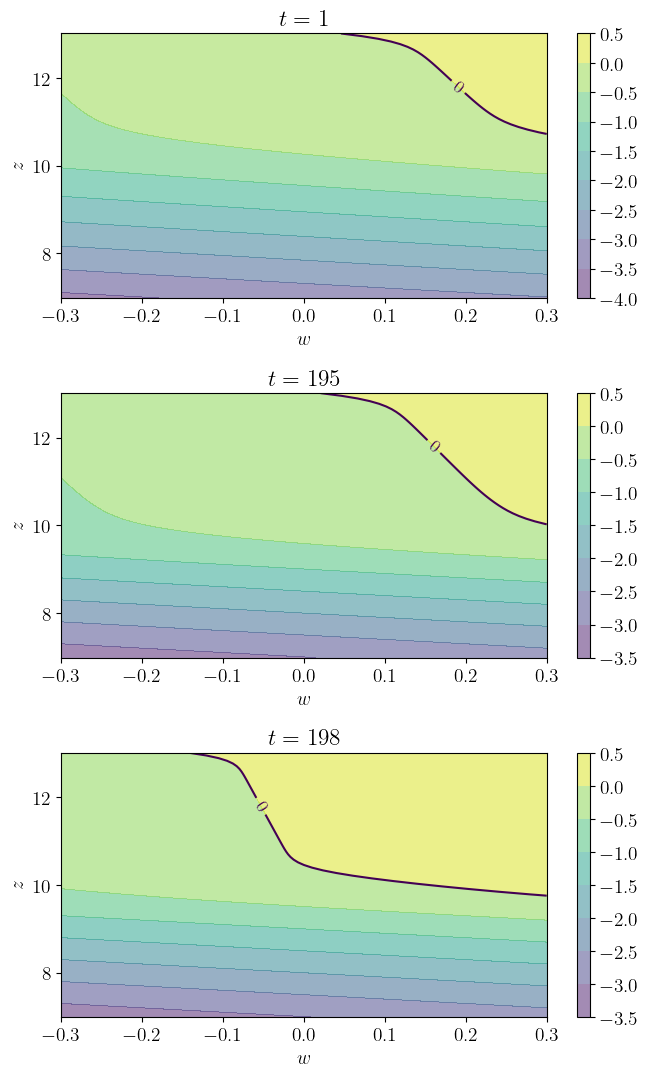

def plot_contours(savefig=False,

figname="./figures/american_option_1.pdf"):

model = create_american_option_model()

t_vals, z_vals, w_vals, Q, φ, T, β, K = model

h_star = compute_cvf(model)

fig, axes = plt.subplots(3, 1, figsize=(7, 11))

z_idx, w_idx = np.arange(len(z_vals)), np.arange(len(w_vals))

H = np.zeros((len(w_vals), len(z_vals)))

for (ax_index, t) in zip(range(3), (1, 195, 198)):

ax = axes[ax_index]

for i_w in prange(len(w_vals)):

for i_z in prange(len(z_vals)):

H[i_w, i_z] = exit_reward(t, w_vals[i_w], z_vals[i_z], T,

K) - h_star[t, i_z]

cs1 = ax.contourf(w_vals, z_vals, np.transpose(H), alpha=0.5)

ctr1 = ax.contour(w_vals, z_vals, np.transpose(H), levels=[0.0])

plt.clabel(ctr1, inline=1, fontsize=13)

plt.colorbar(cs1, ax=ax)

ax.set_title(f"$t={t}$")

ax.set_xlabel(r"$w$")

ax.set_ylabel(r"$z$")

fig.tight_layout()

if savefig:

fig.savefig(figname)

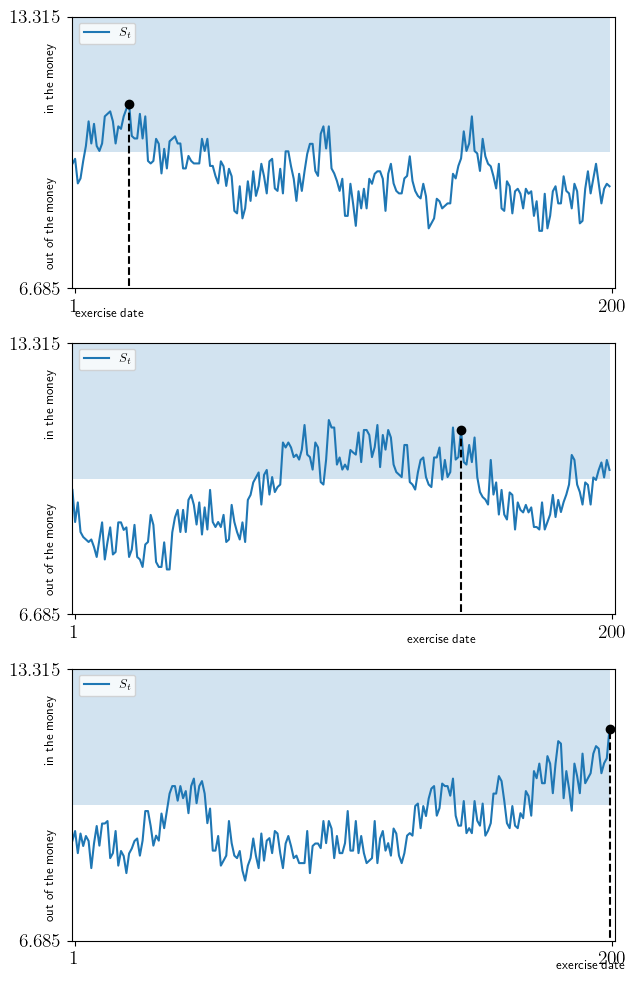

def plot_strike(savefig=False,

fontsize=9,

figname="./figures/american_option_2.pdf"):

model = create_american_option_model()

t_vals, z_vals, w_vals, Q, φ, T, β, K = model

h_star = compute_cvf(model)

# Built Markov chains for simulation

z_mc = MarkovChain(Q, z_vals)

P_φ = np.zeros((len(w_vals), len(w_vals)))

for i in range(len(w_vals)): # Build IID chain

P_φ[i, :] = φ

w_mc = MarkovChain(P_φ, w_vals)

y_min = np.min(z_vals) + np.min(w_vals)

y_max = np.max(z_vals) + np.max(w_vals)

fig, axes = plt.subplots(3, 1, figsize=(7, 12))

for ax in axes:

# Generate price series

z_draws = z_mc.simulate_indices(T, init=int(len(z_vals) / 2 - 10))

w_draws = w_mc.simulate_indices(T)

s_vals = z_vals[z_draws] + w_vals[w_draws]

# Find the exercise date, if any.

exercise_date = T + 1

for t in range(T):

k = exit_reward(t, w_vals[w_draws[t]], z_vals[z_draws[t]], T, K) - \

h_star[w_draws[t], z_draws[t]]

if k >= 0:

exercise_date = t

if exercise_date >= T:

print("Warning: Option not exercised.")

else:

# Plot

ax.set_ylim(y_min, y_max)

ax.set_xlim(0, T+1)

ax.fill_between(range(T), np.ones(T) * K, np.ones(T) * y_max, alpha=0.2)

ax.plot(range(T), s_vals, label=r"$S_t$")

ax.plot((exercise_date,), (s_vals[exercise_date]), "ko")

ax.vlines((exercise_date,), 0, (s_vals[exercise_date]), ls="--", colors="black")

ax.legend(loc="upper left", fontsize=fontsize)

ax.text(-10, 11, "in the money", fontsize=fontsize, rotation=90)

ax.text(-10, 7.2, "out of the money", fontsize=fontsize, rotation=90)

ax.text(exercise_date-20, 6,

"exercise date", fontsize=fontsize)

ax.set_xticks((1, T))

ax.set_yticks((y_min, y_max))

if savefig:

fig.savefig(figname)

plot_contours()

Iteration Distance Elapsed (seconds)

---------------------------------------------

25 6.682e-03 1.712e+00

50 3.997e-03 1.793e+00

75 2.923e-03 1.875e+00

100 1.960e-03 1.961e+00

125 1.242e-03 2.043e+00

150 7.739e-04 2.124e+00

175 4.811e-04 2.207e+00

200 0.000e+00 2.289e+00

Converged in 200 steps

plot_strike()

Iteration Distance Elapsed (seconds)

---------------------------------------------

25 6.682e-03 8.388e-02

50 3.997e-03 1.649e-01

75 2.923e-03 2.513e-01

100 1.960e-03 3.349e-01

125 1.242e-03 4.179e-01

150 7.739e-04 5.030e-01

175 4.811e-04 5.860e-01

200 0.000e+00 6.693e-01

Converged in 200 steps