Chapter 6: Stochastic Discounting#

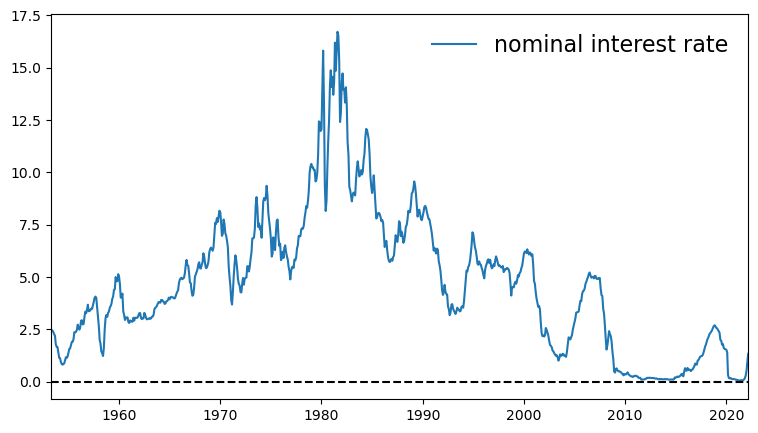

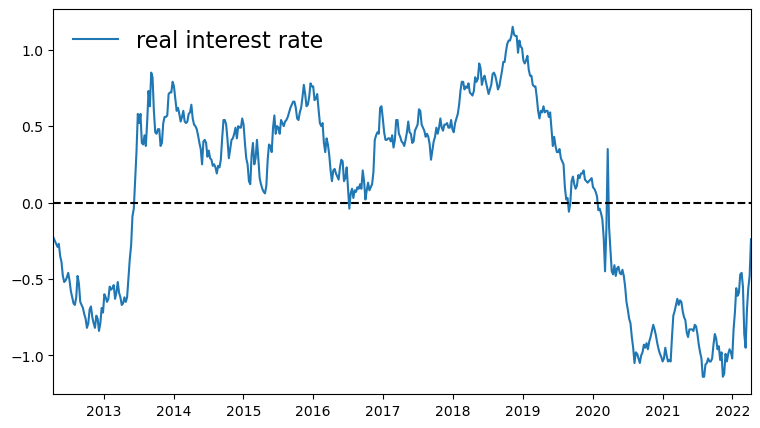

plot_interest_rates.jl#

# Nominal interest rate from https://fred.stlouisfed.org/series/GS1

# Real interest rate from https://fred.stlouisfed.org/series/WFII10

#

# Download as CSV files

#

using DataFrames, CSV, PyPlot

df_nominal = DataFrame(CSV.File("data/GS1.csv"))

df_real = DataFrame(CSV.File("data/WFII10.csv"))

function plot_rates(df; fontsize=16, savefig=true)

r_type = df == df_nominal ? "nominal" : "real"

fig, ax = plt.subplots(figsize=(9, 5))

ax.plot(df[!, 1], df[!, 2], label=r_type*" interest rate")

ax.plot(df[!, 1], zero(df[!, 2]), c="k", ls="--")

ax.set_xlim(df[1, 1], df[end, 1])

ax.legend(fontsize=fontsize, frameon=false)

if savefig

fig.savefig("./figures/plot_interest_rates_"*r_type*".pdf")

end

end

plot_rates (generic function with 1 method)

plot_rates(df_nominal, savefig=true)

plot_rates(df_real, savefig=true)

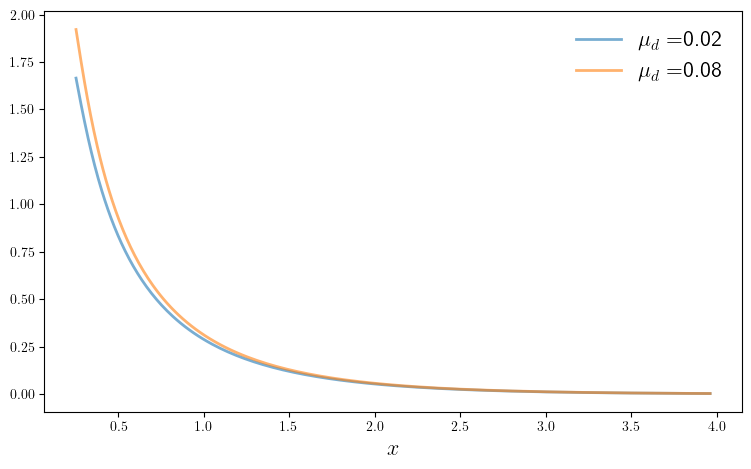

pd_ratio.jl#

"""

Price-dividend ratio in a model with dividend and consumption growth.

"""

using QuantEcon, LinearAlgebra

"Creates an instance of the asset pricing model with Markov state."

function create_asset_pricing_model(;

n=200, # state grid size

ρ=0.9, ν=0.2, # state persistence and volatility

β=0.99, γ=2.5, # discount and preference parameter

μ_c=0.01, σ_c=0.02, # consumption growth mean and volatility

μ_d=0.02, σ_d=0.1) # dividend growth mean and volatility

mc = tauchen(n, ρ, ν)

x_vals, P = exp.(mc.state_values), mc.p

return (; x_vals, P, β, γ, μ_c, σ_c, μ_d, σ_d)

end

" Build the discount matrix A. "

function build_discount_matrix(model)

(; x_vals, P, β, γ, μ_c, σ_c, μ_d, σ_d) = model

e = exp.(μ_d - γ*μ_c + (γ^2*σ_c^2 + σ_d^2)/2 .+ (1-γ)*x_vals)

return β * e .* P

end

"Compute the price-dividend ratio associated with the model."

function pd_ratio(model)

(; x_vals, P, β, γ, μ_c, σ_c, μ_d, σ_d) = model

A = build_discount_matrix(model)

@assert maximum(abs.(eigvals(A))) < 1 "Requires r(A) < 1."

n = length(x_vals)

return (I - A) \ (A * ones(n))

end

# == Plots == #

using PyPlot

using LaTeXStrings

PyPlot.matplotlib[:rc]("text", usetex=true) # allow tex rendering

fontsize=16

default_model = create_asset_pricing_model()

function plot_main(; μ_d_vals = (0.02, 0.08),

savefig=false,

figname="./figures/pd_ratio_1.pdf")

fig, ax = plt.subplots(figsize=(9, 5.2))

for μ_d in μ_d_vals

model = create_asset_pricing_model(μ_d=μ_d)

(; x_vals, P, β, γ, μ_c, σ_c, μ_d, σ_d) = model

v_star = pd_ratio(model)

ax.plot(x_vals, v_star, lw=2, alpha=0.6, label=L"\mu_d="*"$μ_d")

end

ax.legend(frameon=false, fontsize=fontsize)

ax.set_xlabel(L"x", fontsize=fontsize)

if savefig

fig.savefig(figname)

end

end

plot_main (generic function with 1 method)

plot_main(savefig=true)

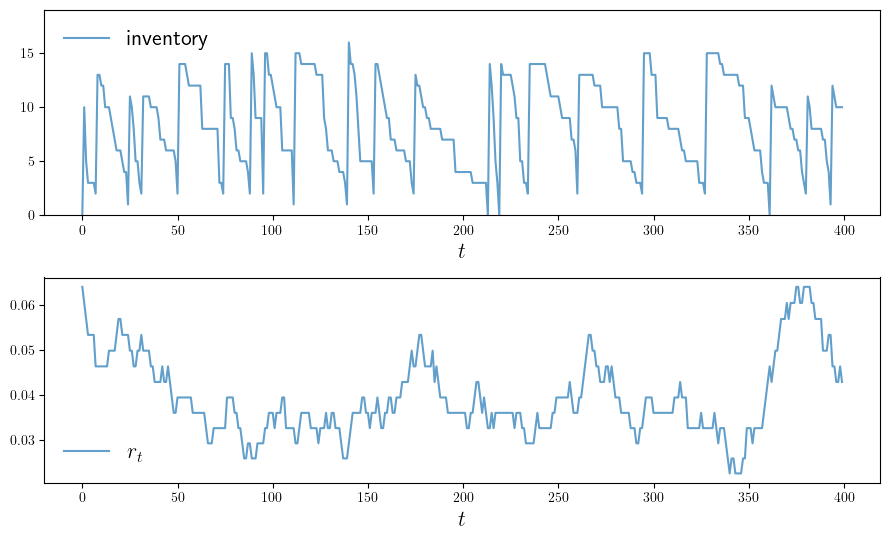

inventory_sdd.jl#

"""

Inventory management model with state-dependent discounting.

The discount factor takes the form β_t = Z_t, where (Z_t) is

a discretization of the Gaussian AR(1) process

X_t = ρ X_{t-1} + b + ν W_t.

"""

include("s_approx.jl")

using LinearAlgebra, Distributions, QuantEcon

function create_sdd_inventory_model(;

ρ=0.98, ν=0.002, n_z=20, b=0.97, # Z state parameters

K=40, c=0.2, κ=0.8, p=0.6) # firm and demand parameters

ϕ(d) = (1 - p)^d * p # demand pdf

y_vals = collect(0:K) # inventory levels

mc = tauchen(n_z, ρ, ν)

z_vals, Q = mc.state_values .+ b, mc.p

ρL = maximum(abs.(eigvals(z_vals .* Q)))

@assert ρL < 1 "Error: ρ(L) ≥ 1." # check ρ(L) < 1

return (; K, c, κ, p, ϕ, y_vals, z_vals, Q)

end

m(y) = max(y, 0) # Convenience function

"The function B(x, a, v) = r(x, a) + β(x) Σ_x′ v(x′) P(x, a, x′)."

function B(x, i_z, a, v, model; d_max=100)

(; K, c, κ, p, ϕ, y_vals, z_vals, Q) = model

z = z_vals[i_z]

revenue = sum(min(x, d)*ϕ(d) for d in 0:d_max)

current_profit = revenue - c * a - κ * (a > 0)

cv = 0.0

for i_z′ in eachindex(z_vals)

for d in 0:d_max

cv += v[m(x - d) + a + 1, i_z′] * ϕ(d) * Q[i_z, i_z′]

end

end

return current_profit + z * cv

end

"The Bellman operator."

function T(v, model)

(; K, c, κ, p, ϕ, y_vals, z_vals, Q) = model

new_v = similar(v)

for (i_z, z) in enumerate(z_vals)

for (i_y, y) in enumerate(y_vals)

Γy = 0:(K - y)

new_v[i_y, i_z], _ = findmax(B(y, i_z, a, v, model) for a in Γy)

end

end

return new_v

end

"Get a v-greedy policy. Returns a zero-based array."

function get_greedy(v, model)

(; K, c, κ, p, ϕ, y_vals, z_vals, Q) = model

n_z = length(z_vals)

σ_star = zeros(Int32, K+1, n_z)

for (i_z, z) in enumerate(z_vals)

for (i_y, y) in enumerate(y_vals)

Γy = 0:(K - y)

_, i_a = findmax(B(y, i_z, a, v, model) for a in Γy)

σ_star[i_y, i_z] = Γy[i_a]

end

end

return σ_star

end

"Use successive_approx to get v_star and then compute greedy."

function solve_inventory_model(v_init, model)

(; K, c, κ, p, ϕ, y_vals, z_vals, Q) = model

v_star = successive_approx(v -> T(v, model), v_init)

σ_star = get_greedy(v_star, model)

return v_star, σ_star

end

# == Plots == #

using PyPlot

using PyPlot

using LaTeXStrings

PyPlot.matplotlib[:rc]("text", usetex=true) # allow tex rendering

# Create an instance of the model and solve it

model = create_sdd_inventory_model()

(; K, c, κ, p, ϕ, y_vals, z_vals, Q) = model

n_z = length(z_vals)

v_init = zeros(Float64, K+1, n_z)

println("Solving model.")

v_star, σ_star = solve_inventory_model(v_init, model)

z_mc = MarkovChain(Q, z_vals)

"Simulate given the optimal policy."

function sim_inventories(ts_length; X_init=0)

i_z = simulate_indices(z_mc, ts_length, init=1)

G = Geometric(p)

X = zeros(Int32, ts_length)

X[1] = X_init

for t in 1:(ts_length-1)

D′ = rand(G)

X[t+1] = m(X[t] - D′) + σ_star[X[t] + 1, i_z[t]]

end

return X, z_vals[i_z]

end

function plot_ts(; ts_length=400,

fontsize=16,

figname="./figures/inventory_sdd_ts.pdf",

savefig=false)

X, Z = sim_inventories(ts_length)

fig, axes = plt.subplots(2, 1, figsize=(9, 5.5))

ax = axes[1]

ax.plot(X, label="inventory", alpha=0.7)

ax.set_xlabel(L"t", fontsize=fontsize)

ax.legend(fontsize=fontsize, frameon=false)

ax.set_ylim(0, maximum(X)+3)

# calculate interest rate from discount factors

r = (1 ./ Z) .- 1

ax = axes[2]

ax.plot(r, label=L"r_t", alpha=0.7)

ax.set_xlabel(L"t", fontsize=fontsize)

ax.legend(fontsize=fontsize, frameon=false)

#ax.set_ylim(0, maximum(X)+8)

plt.tight_layout()

if savefig == true

fig.savefig(figname)

end

end

Solving model.

Completed iteration 25 with error 0.5612439473730824.

Completed iteration 50 with error 0.33434255762250586.

Completed iteration 75 with error 0.16028703786853526.

Completed iteration 100 with error 0.09011797568146562.

Completed iteration 125 with error 0.049802462719462426.

Completed iteration 150 with error 0.027161672509890877.

Completed iteration 175 with error 0.014707249128775857.

Completed iteration 200 with error 0.007932294742488466.

Completed iteration 225 with error 0.004269072929773188.

Completed iteration 250 with error 0.0022948708510455162.

Completed iteration 275 with error 0.001232831534892398.

Completed iteration 300 with error 0.0006620584060144097.

Completed iteration 325 with error 0.0003554717469143043.

Completed iteration 350 with error 0.00019083936177111127.

Completed iteration 375 with error 0.00010244851192453552.

Completed iteration 400 with error 5.499580430523565e-5.

Completed iteration 425 with error 2.952200834016594e-5.

Completed iteration 450 with error 1.5847402693225376e-5.

Completed iteration 475 with error 8.506835150967618e-6.

Completed iteration 500 with error 4.566428842167625e-6.

Completed iteration 525 with error 2.4512335414783593e-6.

Completed iteration 550 with error 1.3158073528529712e-6.

Terminated successfully in 563 iterations.

plot_ts (generic function with 1 method)

plot_ts(savefig=true)